“The property market in the UK threatens the overall economy,” and similar developments are determined by the British property market.

The government has helped to heat up the demand for real estate vigorously. Buyers can obtain loans at favourable conditions and with virtually no equity. 5% of the purchase price is all that is needed to apply for a house purchase, thanks to government support for the buyer. As a consequence, the prices of real estate are rising rapidly.

Contents

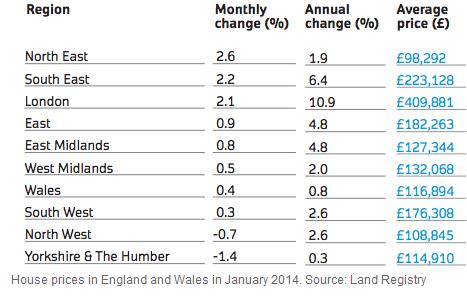

Consequence: Rapid rise in prices

Since 2000, housing prices have risen in Britain by 109%. The average price of a house has risen to a new high of the equivalent of about 230,000 euros. Since the spring of 2013, the prices recorded have increased massively in the UK, especially in London where the property price index has risen by about 45 percent since the spring of 2013. In 1997 the price increase recorded within one quarter was matched by that of only July of this year.

Britain is one of the potential candidates for a real estate bubble according to IMF

1.445 trillion pounds, the total indebtedness of private households; this also at an unprecedented peak. Other sectors of the economy cannot keep up the pace, and so the debts created could cause a drop in the real estate market that would consequently unhinge the whole UK economy.

As real estate continues to be among the safest investments, it pays to look abroad, e.g. to Mallorca or Ibiza, as here it is quite a different picture.

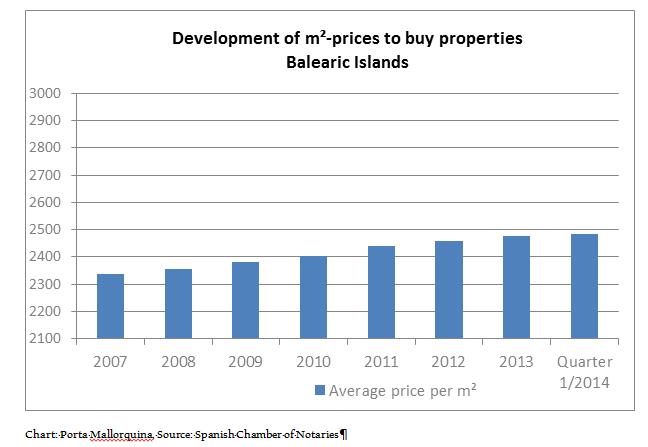

Annual price increase below inflation

Comparing the data published by the Spanish Chamber of Notaries, the average prices of homes sold per m2 have risen only slightly.

With average annual inflation rates below 1%, real estate prices are below the average inflation rate in Spain, which between 2007 and 2013 was on average 2.4%.

So in 2007 the cost of a residential property in the Balearics averaged of 2,336, – € / m². In the following seven years, prices per year have increased only minimally. In the first quarter of 2014, the average price per square metre for properties in Mallorca, Ibiza or Menorca is only 2,483, – € / m².

Holiday rentals as an investment alternative

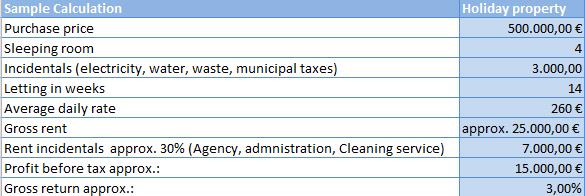

A holiday property in Spain is a safe alternative for investors. Especially since the liberalisation of holiday rentals in 2012, attractive returns can be earned from holiday guests.

An example calculation for a holiday home in Majorca in a good location (sea views, near beach), with good facilities and a private pool.

As the example shows, you can expect attractive returns from renting the house out for a full season (summer months June-September) whilst still taking advantage of the house for yourself for around 40 weeks of the year.

The broker choice for holiday homes

Since the end of 2013 thanks to new holiday brand “Porta Holiday”, Porta Mondial offers not only sale properties, but also holiday rentals from a single source. Currently, only houses in Mallorca are on offer, but this will be extended to include all holiday destinations in Spain.

You can buy and sit back and relax as we take care of the entire management and holiday rental of your property,

says Porta Mondial AG CEO Joachim Semrau about the new service.