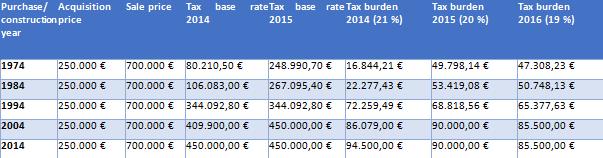

The proceeds from the sale of a property in Spain are taxable even for non-residents. From 2015, the tax rate on income to persons whose principal residence is in the EU is 20% instead of the previous 21%. For resident property sales in Spain, the tax burden from next year will be 24% instead of 27% (from gross income from the sale of over 24,000, – €).

Especially for owners who purchased their house in Majorca before 1994 and now want to sell it, the new tax law in 2015 might be infavourable.

Is this good news for sellers? Unfortunately not, because the tax reform has caused the government to retroactively “compensate for inflation and reduction coefficients” from which, there is a significant taxable income especially on older properties.

Sales in 2014 are still worthwhile

Hit especially hard are the non-resident owners who have purchased or built their property before the year 1994, for more than 400,000, – € sales revenue. For them, a sale from 2015 will be a significantly higher tax burden than it was in 2014.

Gabriel Buades of Bufete Buades in Palma de Mallorca asserted:

“The proposed abolition of inflation adjustment and reduction coefficients is unfair because starting next year, not only will the capital gain be charged, but it will be taxed with inflation, since no inflation adjustment is possible. In my opinion, the taxation of the profits from the sale of assets should be the ONLY the real burden on the taxpayer, but NOT the inflation, as will be the case from 2015 “.

Residents also meet this new regulation unless they invest the sale proceeds within 2 years in a new principal residence in Spain, in which case the entire sale proceeds remain tax-free. Otherwise, the capital gains must be taxed at 24% – without reduction coefficients and inflation.

Tax loophole for seniors

Seniors are an exception,

“those over 65 years old, with tax residence in Spain for at least three years which has led to selling property as a primary residence, this property can be sold tax-free as long as certain conditions are met”

Gabriel Buades explained of the new tax law.

Renovation costs impact on revenue

A ray of hope for sellers is that renovation costs and conversion measures continue to be recognised as a revenue reduction that can be applied and so reduce the notional taxable profit

.