Porta Mallorquina Real Estate presents a new market study

Contents

- Market Study Holiday Property Market Mallorca Results 2021

- Market volume, location and specifications

- Market offers according to specification details

- Price level

- Historical developments

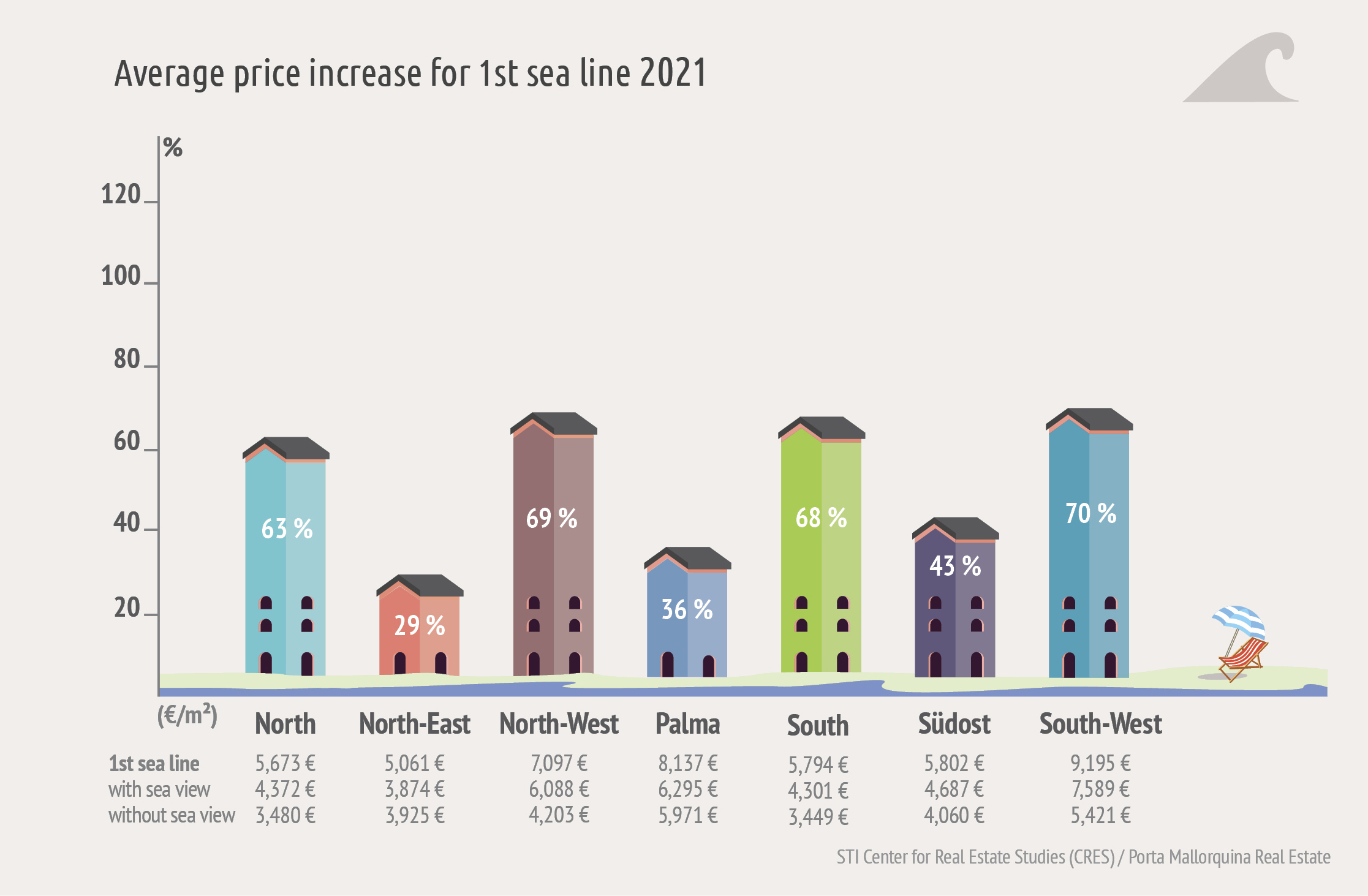

- Exclusive sea views mean significantly higher prices

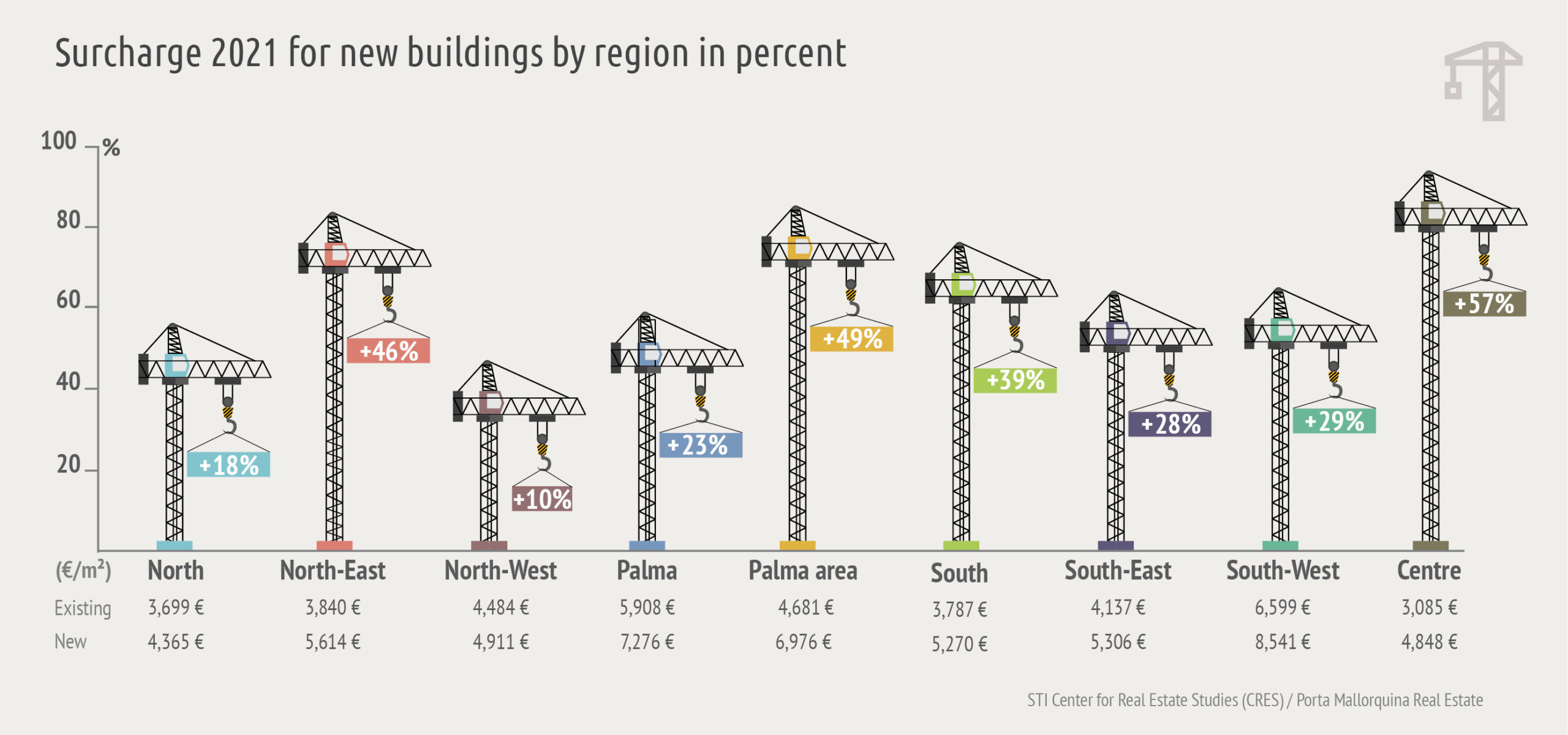

- Newly-built properties and holiday communities

- The typical property

- Conclusions and forecast

- Macrolocation Mallorca

- Market study to download

Market Study Holiday Property Market Mallorca Results 2021

Since 2015, the Steinbeis Transfer Institute (STI) Centre for Real Estate Studies (CRES) has been conducting regular market studies on the holiday property markets in Mallorca, Ibiza and Menorca on behalf of Porta Mallorquina Real Estate. The focus of this study, which is being carried out for the seventh time, is on holiday properties for sale in Mallorca.

This market study aims to provide an up-to-date overview and can be used during a long-term comparison to check the value of your investments. Apart from the “emotional return” when finding the right property, rational considerations of the “monetary return” are becoming increasingly important in these times of low interest rates. The question arises, therefore, of current price drivers, and the price norm in regions and market segments but also, especially in the premium segment, the price of luxury properties or prices per square metre in very desirable sub-regions.

As in previous years, the properties offered by the largest real estate agents on Mallorca were collated and manually and statistically evaluated. The results represent around 90 percent of market offers available in Mallorca at the beginning of 2021 and can therefore be considered representative, and independent of providers.

Further information on the data collection and scientific adjustment as well as the objectives of the study can be found from page 14 onwards. For comparability, the methods and presentation of the results correspond to the routine procedures of previous years.

Despite the slump in tourist numbers, prices for vacation properties have remained largely stable since the beginning of the pandemic.

Market volume, location and specifications

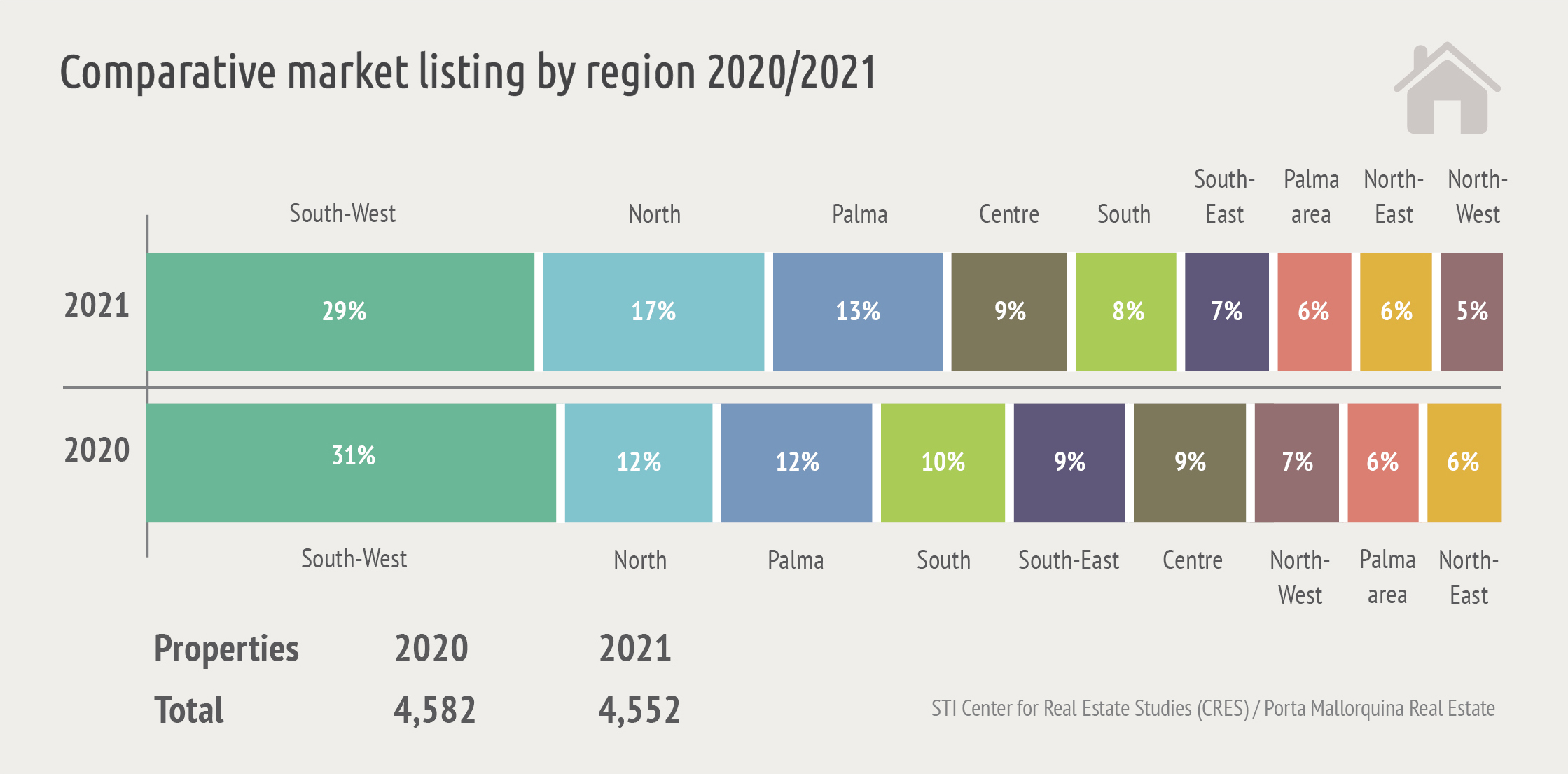

At the start of 2021 around 4.600 properties of various categories were again offered for sale in Mallorca. Compared to the previous year the amount of offers on the island has remained almost the same, although comparisons with the previous year are more difficult to classify at this point. The brokerage house Kühn und Partner is no longer present, which is why the market was re-evaluated in order to retain an appropriate market representation. In addition to the island-wide brokerage companies Porta Mallorquina Real Estate, Engel & Völkers, Minkner & Partner and First Mallorca, the company Balearic Properties was included in the study for the first time in 2021. This real estate broker also offers properties island-wide, but its focus is more on the northern part of the island.

The region with the largest number of offers remains, by far, the south-west with a share of around 30%. It is followed by the north with about 17%. As mentioned the new provider Balearic Properties is very strongly represented here but with somewhat lower-priced objects, hence the significant increase in offers from this region. Palma city is again in third place with 13%; and together with the surrounding area bordering Palma provides 19% of the offers on the island. This also represents another slight increase compared to the previous year. In the remaining regions, the difference in the number of offers compared to the previous year is in the low percentage range.

For the first time special attention was paid to construction-project planning. Here a close look was taken at whether very detailed project plans were sold as such, for example including project services. The latter is the decisive difference to pure land sales (sometimes with buildings ready for demolition), which advertise beautiful possible projects, but where the building project itself would have to be carried out by the purchaser. A particular challenge in the project analysis was to distinguish whether a building project was still purely in the planning or construction stage, or whether it had already been completed and would therefore have to be recorded as a new building offered for sale.

A total of 621 building projects were additionally recorded and evaluated. Around a third (33%) of these projects are located in Palma city, another quarter (27%) in the sought-after and higher-priced south-west, and the south-east came third with 12%. On average, the price of all projects is well above the island-wide average and about the same as the average for new buildings, which was to be expected. Further comparisons to the projects were not made in this study, as no basis exists for comparison with the year before.

Market offers according to specification details

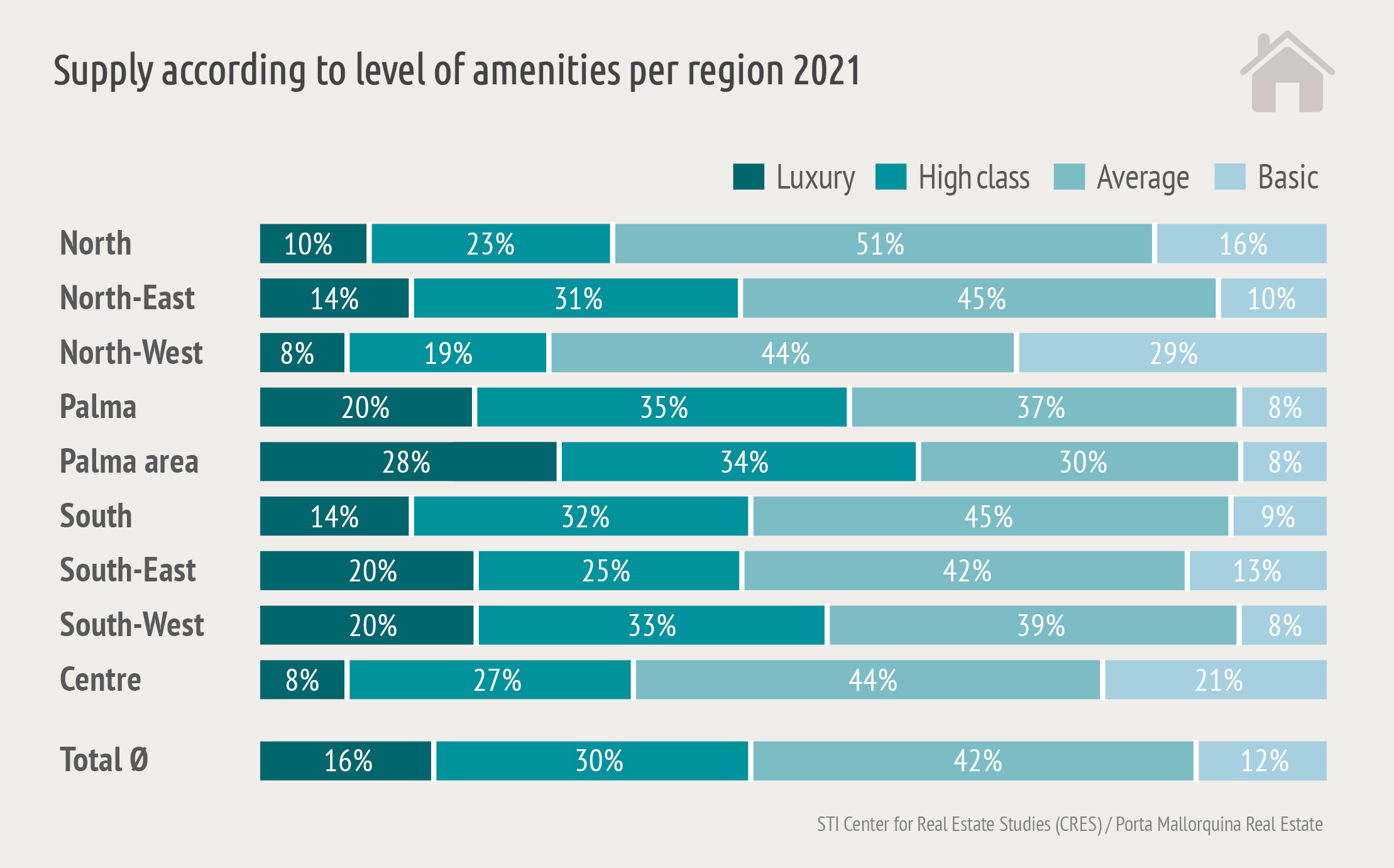

Mallorca is characterised mainly by properties in the exclusive or luxury class. In order to avoid the risk of exaggerations, however, the descriptions in the exposé texts on the websites of the providers examined were, as in previous years, intensively examined and subjected to plausibility checks.

Across the island there is a clear difference between the basic and the mid-range specification levels. Basic properties now have a share of around 12% (2020 18%), the mid-range properties have risen proportionally to 42% (2020 35%), while the other two higher-priced segments – “upmarket” (30% 2020 and 2021) and “luxury” (16%, 2020 17%) remain almost constant.

Within the regions a very mixed picture of shifts in the equipment standards is shown.

Price level

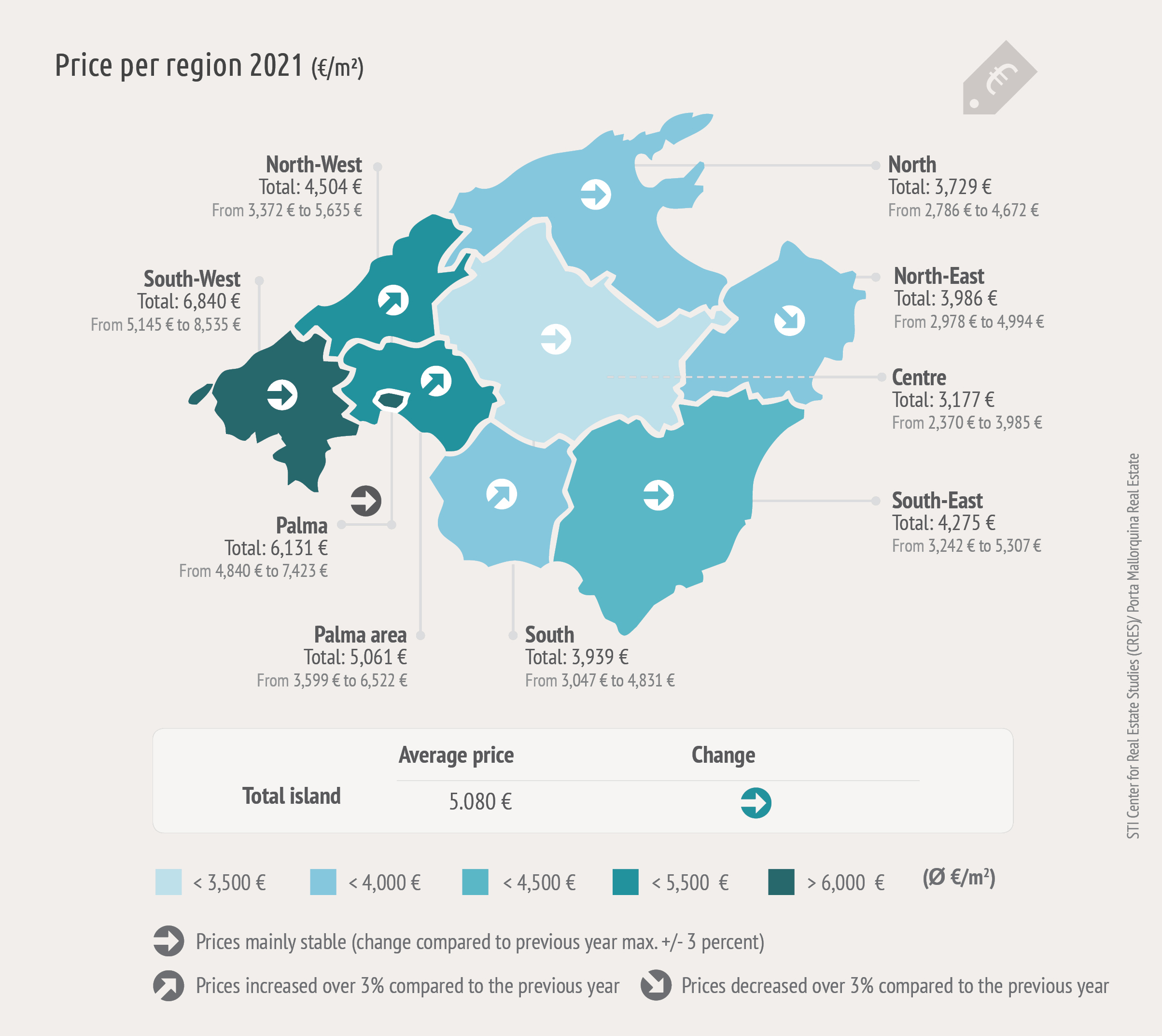

Island-wide, the average price has remained almost exactly at the previous year’s level despite the Corona pandemic, with the average at around €5,080 per square metre. Within the individual regions, however, there were more significant price changes, in addition to the aforementioned shifts in the range of individual features.

The highest price increase, however, was recorded in the north-west region, where prices rose by 10%. On average, a square metre here costs around €4,500 but this large price jump is not due to the upscale and luxury properties where prices stagnated or even fell. The share of mid-range properties has increased at the expense of basic properties, so that the average price has risen due to this levelling effect. In addition, however, holiday properties in both segments were offered at prices which were over 15% higher. Overall, about 75% of all properties in the region are in the lower and middle segments.

The second highest price increase was recorded in the south (3,939 €) as well as in the Palma region (5,061 €). In both areas prices rose by around 4%. These two regions were last year’s big losers and had recorded double-figure losses, making this catching-up or price correction not necessarily surprising. The reasons for this, however, are clearly to be found in the structure of the features – in both regions there was a very similar sharp decline in more basically-equipped properties, a slight increase in medium and upscale properties and a significant increase in luxury properties.

There were also price increases in the centre and in the north, by 3% in each case. In both regions, the proportion of simpler properties fell significantly and was distributed mainly amongst the medium and upmarket properties, together with a small proportion of luxury properties.

Across the island, the average price has remained almost exactly at the previous year’s level despite the corona pandemic.

In Palma City, prices remained almost stable despite Corona (€6,131, -1%), with only a slight decline noticeable which can easily be explained by the slightly higher share of medium-priced properties.

The most expensive region, the south-west (€6,840), also saw a slight price decline of -2%. Here the supply of the more basic and the mid-range properties increased in relative terms, but significantly fewer luxury properties were offered. It is also noticeable here that prices in the simple to upmarket segment rose significantly in some cases, while in the luxury segment they fell somewhat, but due to this strong shift in the supply structure the overall prices in the entire region nevertheless fell.

In the south-east (4,275 €, -3%) prices fell somewhat more markedly. The supply structure shows a decline particularly in the upmarket segment, while the simple (moderate) and luxury (significant) segments gained proportionately. In terms of prices, the picture is the opposite of that in the south-west. For example, the basic to upmarket segment recorded slight price declines, the luxury segment very slight price increases.

The strongest price decline this year is in the north-east (3,986 €, -9%). In the supply structure the simpler properties surprisingly declined significantly, but also the more luxurious properties, and a large part of the supply is in the middle segment. The prices within the equipment categories are similar to those in the south-east. Only the luxury segment is gaining, while prices in the other categories are falling.

In the regional price rankings the top spots stayed unchanged with the south-west ahead of Palma city and then Palma surroundings. The north-west moved up to 4th place due to its strong price increase and the simultaneous losses in the south-east and north-east, putting the latter two regions in 4th and 5th place. The south overtakes the north in terms of price, while the island-centre remains by far the cheapest region.

Finally, it should be noted that the distribution of values has increased in all regions, and statistically this is highest in the Palma region.

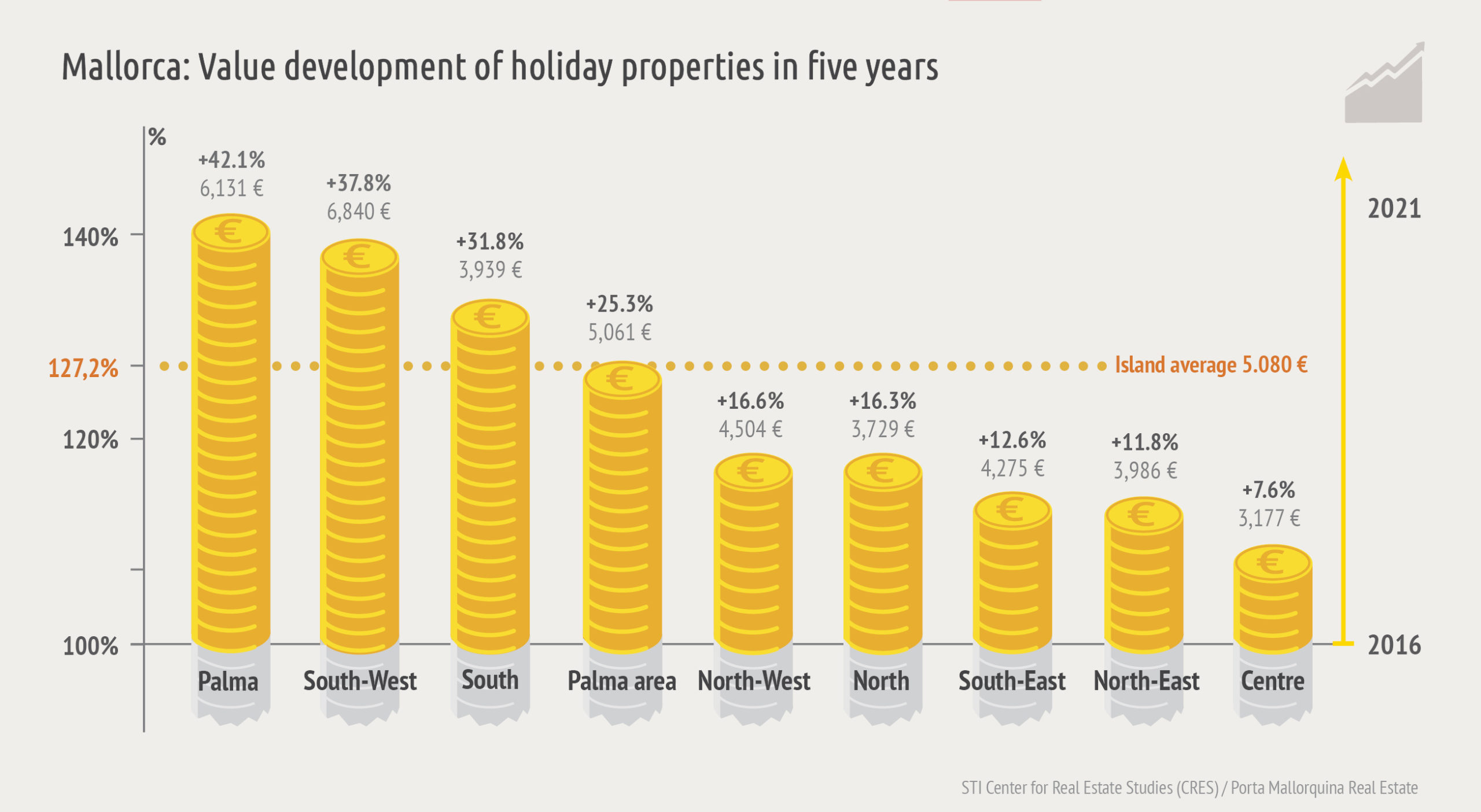

Historical developments

After the strong price dynamics of the last few years the market is moving sideways and is more cautionary in 2020/2021. The average price increase across the entire island has been around 4.9% per year since 2016 (27% in absolute terms). Only three of the nine regions, however, developed more strongly than the island-wide average:- Palma city 7.3%, the south-west 6.6% and the south 5.7% per year. The other regions have all seen positive growth since 2016, but this was below the island-wide average.

When comparing the price ranking this year with those of 2016 it is noticeable that this year there are no big jumps. Although several regions were still relatively close to each other in terms of price in 2016, only the south and the centre have changed places since then with the south having made strong price gains, putting it on a par with the north-west. The centre has also seen price increases since then, but at 1.5% they are island-wide the smallest.

Since this year no region has been able to record a consistent price growth. Until last year Palma city and the south-west did so, but both have recorded slight price decreases this year.

Exclusive sea views mean significantly higher prices

As was the case last year the trend continues with excellent sea views meaning significantly higher prices, and the price gap between a superb sea view and no sea view continues to widen. Island-wide the top sea view now costs 75% more. The prices for a top sea view have risen by 4% overall without taking into account the other factors influencing prices, whereas the prices for a lower-quality sea view have stagnated, and for properties without sea views they have fallen by around 1%.

Proportionately top sea views continue to be found more often in the luxury property category where more than one in seven properties have them, whereas n the other categories it is only a half to a quarter as many properties.

In contrast to last year no properties in the Palma surrounds could be found offering excellent sea views, whereas last year this was the region with the highest price premium and the highest average price for them. Due to its limited locations, however, the number of elevated properties in this region which can meet the requirements for a top sea view are few. Unfortunately none of these properties were for sale during the survey period.

In the remaining regions the price differences between the top sea view and properties without sea view has harmonised somewhat. Conspicuously, as was the case last year properties in the north-east without sea views have increased in price somewhat more than properties with a partial sea view. This is a clear indication that the price in this region depends on considerably more parameters than only sea views.

Other price-determining factors, apart from the level of the equipment quality already considered and sea views as a location parameter (apart from the region in general), can also be a pool and/or a Jacuzzi.

Not surprisingly, there are proportionately more top-pools in luxury properties – around every fifth property has an exceptional-quality pool and another two-thirds of the objects have a normal pool. In the basic to upscale segment only 5 to 8% of the properties have an exclusive pool, whilst in the simpler properties more than two-thirds have no pool at all. The factor of a pool should not, however, have too much importance attached then, as mentioned above, several other factors also influence the price. Nonetheless, as was the case last year,it is noticeable that the price gap between properties with a top-quality pool and those with no a pool is very wide, particularly in the Palma area. The proportion of properties with a pool is also significantly higher here than in all other regions and only 8% have no pool. In the south-west, the region with the second most pools, already 19% of all properties offered do not have a pool.

A pool has almost become standard equipment in holiday homes and two out of three houses have one. In luxury properties the pool is also more often to a higher standard and can be, for example, an infinity or extra – large pool, or heatable, and luxury properties without a pool are the exception Simpler properties, on the other hand, have a pool much less frequently and two-thirds of this category have no pool at all.

If only the presence of a Jacuzzi is considered, the general findings are initially as for the pool. Every seventh luxury property has a Jacuzzi, whereas only around 2 to 5% of the simple to upscale properties have one. On average, properties with a Jacuzzi are more expensive than those without.

As far as prices regarding pool and jacuzzi are concerned, it is generally so that properties with a Jacuzzi are more expensive than those without, and the larger the pool or the more attractive the pool landscape, the more expensive the property will be. If a seller can afford to invest in a normal pool before offering the property for sale this could be very worthwhile in the case of an average house (this is referred to in the section “The typical property”).

There follows a rough calculation: An existing house with a medium equipment level, not located in a holiday complex, without a rental licence, without a Jacuzzi, sea views or a pool, should cost around 3,015 € per square metre throughout the island. An identical property but with a normal pool, on the other hand, costs €3,764 per square metre – about 25% more. If an average house size of 300 square metres is assumed, the property with a pool will, therefore, sell for around 225,000 € more. Roughly speaking, an amount of 30,000 € to 40,000 € can normally be estimated to build a decent pool so that investing in a pool for 40,000 € before selling can increase the selling price by up to 20%.

A first-class sea view is paid significantly higher. And properties with a pool are also more expensive than properties without.

From the buyer’s point of view, on the other hand, it is worthwhile to look for properties without a pool and to make this investment later. A prerequisite for this, however, is a valid building permit.

Newly-built properties and holiday communities

Further property parameters considered were once again the year of construction and the location within the holiday complex. In addition, it was recorded for the first time last year whether the properties had a holiday rental licence. This year, therefore, a comparison can be made for the first time.

Island-wide the proportion of properties in holiday complexes has not changed since last year, and every tenth property is in a residential complex. Considered separately from other price-influencing factors such properties cost around €1,000 more per square metre. Proportionally, lower and medium-class properties are more often found in holiday complexes this year, whereas last year they were evenly distributed among properties in all classes. Not quite as pronounced as last year, but still clearly recognisable, however, is the fact that holiday complexes are more often newly-built.

If differentiated according to type of property, it can be seen that holiday communities are much more typically made up of apartments than houses. Only 3% of all houses, but 24% of all apartments are located in a residential complex. Concerning a top-quality pool, it remains the case that this is more likely to be found in a holiday complex – every third holiday resort has a high-quality pool and/or pool landscape. Outside of holiday resorts only 6% of all properties have this.

As far as newly- constructed advertised properties are concerned, there is very little new information compared to the previous year. Every tenth property advertised is newly-built, and there is no discernible trend between flats or houses under construction. For both existing and new buildings, the ratio is about one-third apartments to two-thirds houses.

Island-wide a new building costs approx. 6,910 € and thus about 42% more than an existing property (4,970 €). Within the regions the premiums for new buildings vary greatly with larger premiums in the north-east (+17 percentage points), in Palma City (-15 percentage points) and in the south-east (+16 percentage points).

The absolute number of new constructions per region also shows a similar picture to last year, and within the regions there is a somewhat larger shift in the Palma hinterland: This year 17% of all advertised properties are new buildings, last year the figure was only 13%. In the north-west, on the other hand, only 5% newly-built and existing houses could be identified this year, with around 9% in 2020.

If new construction is considered in terms of property equipment, significantly more Luxury objects are being built than in the simpler property classes, although there is a slight shift away from the luxury segment compared to the previous year. Overall more than 70% of new buildings are offered in the up-market and luxury segment, 25% in the mid-range and only 4% in the simple segment.

If the second price factor considered is the standard of equipment and fittings, the price gap between an existing building and the equivalent building under construction is clearly widening this year. In the more basic segment a newly-constructed building is about 900 € more expensive (27% more expensive than the existing building), in the middle segment 1,600 € (+38%), in the upper segment 1,300 € (+24%) and in the luxury segment 1,000 € (+13%). At a higher price level and with markedly better equipment the ‘newly-constructed’ category does not have as strong an impact on price as in the case of more simply-equipped holiday properties.

With regard to holiday rental licences no price influence can be identified, and overall it should be noted that about every ninth property was recorded as having a licence. These rental licences are particularly common in the north (22%) and in the centre (21%), whereas in Palma and in the south-west only 3% of all advertised properties are licensed. It should be noted that not every property can simply apply for a holiday rental licence – on the contrary, these licences are highly regulated on the island. There are regions, such as Palma City, where licences are no longer issued. In these regions, where licences are extremely rare, a licence may sometimes have a price-influencing effect on an individual property compared to a similar property nearby.

The typical property

Existing buildings predominate in all regions so that a typical property would not be a new building, and neither a rental licence nor a Jacuzzi are to be found in the majority of the regions. A pool, on the other hand, is usually present but can be classified as normal quality and not in the luxury segment. The only exception is Palma city where there is no pool in the majority of cases, but this is also due to the fact that most of the properties for sale here are apartments and not houses. Otherwise, houses predominate on the holiday property market.

Palma City with a view of the marina and the cathedral.

With regard to equipment there is only one exception – only in the region surrounding Palma does the upscale segment predominate, in all other regions the middle segment is most frequently represented. If the simpler and medium segments and the upscale and luxury segments are combined, the higher equipment levels also predominate in Palma City and in the south-west, (in addition to Palma Umland); in all other regions, the simple and medium segments predominate.

The last distinguishing criterion is the sea-view. Most properties do not have a sea-view, and this is the case in almost all regions. Only in the south-west do the most-impressive and the partial sea- views together account for more than 50%.

Throughout the island, therefore, a typical property is a house with a normal pool, an existing building, with no rental licence, not located within a holiday complex, with a medium level of equipment, without a Jacuzzi and without sea-views. The price per square metre for houses with these characteristics varies between 2,510 € and 4,700 €, the average being 3,530 €. According to the availability situation this property would be situated in the south-west but as noted above, some of the parameters mentioned do not apply to many properties in the south-west. An average house has a construction area of about 280 sqm standing on a plot of land of about 2,000 sqm. It has 4 bedrooms and 3 bathrooms. Overall the average house costs between 650,000 € and 1,500,000 € depending on the region, and the island average is around 995,000 €.

Even though apartments are significantly less represented it can be stated tht the average apartment for sale in Mallorca in 2021 will have just under 100 sqm living space, with 2 bedrooms and 2 bathrooms. The square metre costs between 2,720 € and 4,230 €, on average 3,270 €. Depending on the region, the average living unit costs between €235,000 and €450,000, with an average island-wide price of €320,000. In Palma however, the only region where more apartments than houses are on offer, the circumstances are somewhat different. Here there are almost as many upmarket as mid-range properties, and most of them do not have a pool. On the other hand, an apartment here has an average of 116 sqm and 3 bedrooms and a price of around 640,000 €.

Conclusions and forecast

Four out of nine regions must accept price declines, one of them strong, three only light, and four regions gain between 3% and 4%, and the north-west increases more strongly. For a year which was dominated by the pandemic, this is an annual result that is by no means worse than the more volatile results of previous years. If last year’s forecast is used as a comparison it must be noted that this year’s result was more in line with a worst-case scenario. However, as noted, this should be seen as a positive result, considering the pandemic which caused a year with significantly less tourism in Mallorca.

In view of the ongoing pandemic it is all the more difficult to make further forecasts as the normal statistical forecasting methods used do not take such an external effect into account. Nevertheless, as in previous years, a concept for normal, best-case and worst-case scenarios is set out below.

The modelling approach carried out by CRES comes to the conclusion in the base scenario that the predominantly positive price trend will continue over the next three years, despite last year’s price correction and this year’s stagnation, and that prices of € 6,300 per square metre are feasible in 2024 (+6.0% p.a.). Under less optimistic conditions, the underlying model assumes prices of around €5,200 in 2024, which corresponds to a very slight decline of 0.5% p.a. overall. If the market develops more positively than assumed in the basic scenario, even prices of €7,400 per square metre could be achieved within three years (+11.7% p.a.). This is, as already mentioned, without being able to explicitly take into consideration an external influence such as Corona. The aforementioned figures, therefore, should be treated with caution.

With regard to the forecast, which was made less detailed this year due to the extenuating circumstances, it can be noted that the data obtained speaks at least for a value stability rather than for a further major price decline. (Potential) investors should, therefore, not be overly concerned.

Another trend that has increasingly come into focus in society as a result of the pandemic should also be highlighted here – the home office. In times of the pandemic, many owners of a holiday home on Mallorca may have asked themselves whether the home office could not also be in the holiday home on Mallorca. And even in the near future, when on the one hand a real end to the pandemic is not yet in sight, and on the other hand the home office will be even more popular after the pandemic than it ever was before, working from your favourite holiday destination remains an option. Even if travel limitations are sometimes restrictive: Once you have arrived, have your own home, and are flexible in terms of work, there is no pressure upon you to leave the island due to the political decisions of individual countries.

A new trend: home-office.

Macrolocation Mallorca

Mallorca is generally one of the most popular holiday islands, and particularly amongst Germans it is the most popular Mediterranean island. In the years before the Corona pandemic the number of visitors to the Balearic Islands rose almost continuously, with Mallorca accounting for a large proportion of these visitors and in 2019 around 13.7 million people visited the islands. While the number of visitors to the island in February 2020 was roughly the same as in previous years, the rest of the year is entirely dominated by the pandemic and in the months of April and May the official statistics do not record a single visitor. Despite permitted summer tourism, the number of visitors in the summer months remains significantly below the number in “normal” summer months. In total, around 1,722,000 visitors visited the island during the whole of 2020, the same number which visited the Balearic Islands in the month of May alone in 2019.

Even now, in March 2021, it is already certain that this yearwill also be marked by the pandemic. No matter how well, how far and how quickly the pandemic is overcome, it is hardly to be expected that even one month in 2021 will approach “normal” tourist numbers.

The question remains how this will affect property prices on the islands. It remains to be said that this study already offers a Corona view after almost one year of pandemic. The pandemic certainly has not favoured large price increases – but neither are there any signs of a slump.

Market study to download

To download the 7th market study on Majorca real estate 2021 please click on the picture or here: Market study on Majorca real estate 2021